Company registration in Malaysia for foreigner – Premier Three Consulting Firm

Our services

- Private Limited Company/ Partnership Company Registration in Malaysia for a foreigner/ local known as SDN BHD in Malaysian language.

- Branch office opening assistant

- Accounts and Audit service

- Business License

- Secretarial Jobs

- ESD Registration

- MM2H (Malaysia my 2nd home application)

- Trade Mark license

- SIRIM License

The shareholding structure as our suggestion-

| Share Holding Structure | Required Capital |

| 100% foreign shareholding (only for visa purpose) | RM 500,000 |

| Local + Foreign shareholding (Private Limited Company) | RM 350,000 |

Proposed name

- First of all, recommend three propose name to select.

- There might have a chance of rejection as an inability of a name.

- Cost of name application is Ringgit less than One Hundred.

- It might take 1 to 2 days unless any difficulties arise.

- Three nature of businesses and shareholders passport copies are needful to process.

- Local residential address

- Particulars of shareholders and directors (email, contact number, residential address)

Documents preparation

- Passport copy of shareholder (s) along with local address, email and contact number.

- Memorandum and Article of Association generally prepared by Company Secretary (CS).

- Government fees to register a Sdn Bhd company registration is Ringgit 1010 (One Thousand and Ten).

- SSM (Suruhanjaya Syarikat Malaysia) is a government organ to approve of the registration application.

Required Shareholders

- 1 (one) shareholder can open a company in Malaysia as a foreigner.

- 100% foreign shareholding is allowed in Malaysia, shareholder can be from any country.

Who can be the shareholder?

Any person who is 18 years old and have no record of:-

- Bankruptcy

- Imprisonment

- An allegation in own country

Besides, dependent visa holder can be a shareholder as well as director of a company. Even Student Pass holder is allowed to be shareholder and director of an Sdn Bhd company in Malaysia but in that case, they cannot be the bank account signatory.

Is local shareholder required to register Sdn Bhd Company as a foreigner?

No, the local shareholder is not required to open a company in Malaysia. Benefits of hiring local shareholders:

- Required paid-up capital of Ringgit 350,000/- instead of 500K-1million

- No need for WRT license

- Can get all business licenses within a short time compared to a 100% foreign shareholding company.

Do not hesitate to Contact Us today for immediate Service. Call/Whatsapp us now.

Bank Account Open as Foreigner

Local banks are not flexible if shareholders are foreigners. Premier Three Consulting Firm has partnerships with renowned foreign banks, so for our clients, we can make sure that no matter they have local shareholder or no, Premier Three Consulting Firm can open bank account for anyone, which will be a multi-currency business bank account.

Local banks are not flexible if shareholders are foreigners. Premier Three Consulting Firm has partnerships with renowned foreign banks, so for our clients, we can make sure that no matter they have local shareholder or no, Premier Three Consulting Firm can open bank account for anyone, which will be a multi-currency business bank account.Foreign banks are welcome to foreign shareholding companies upon some conditions: –

- Company background

- Nature of business

- Financial forecasting

- Company physical office

Visa

As foreigners like to stay longer in Malaysia to look after business but the visa is difficult. Any company can NOT apply to hire foreign staffs unless having ESD Approval. We assist our foreign customers in applying for ESD and the approval rate is 100%, if follow our guidelines.

Do not hesitate to Contact Us today for immediate Service. Call/Whatsapp us now.

Why and Who is Company Secretary?

- Company Secretary (CS) appointment for every Sdn Bhd company in Malaysia is a must.

- Only who has a license (from SSM) is permissible to be CS.

- Chartered Secretary qualified member can be CS after approval from SSM.

- Company Secretary is liable to submit audit and annual return for companies.

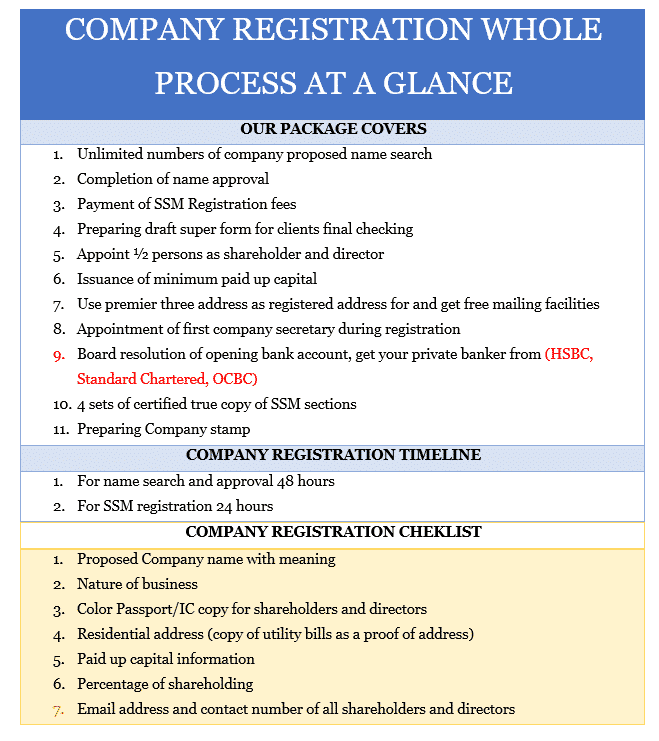

Steps of new company registration in Malaysia for a foreigner/ local:

- Fill up SSM application form, will be provided by Premier Three Consulting Firm.

- Proposed name approval by SSM

- Submission of documents (draft copy of section 14 and 58) to SSM

- Payment confirms by online to SSM. Secretary can pay by online if you make a payment order to Secretary.

- Wait for 1-2 days to get the approval of company registration

- Buy Super Form from online of My Data SSM as this form need to open a bank account (Premier Three Consulting Firm don’t charge separately for Super forms)

- Yearly submission of annual return to SSM to be regular company even business not startup.

- It might take 2-3 days to approve of registration.

- SSM provides some copies- i) Incorporation. ii) Section 14(particulars of shareholders). iii) Section 58 (particulars of company secretary). iv) Section 15 (notification of registration).

Branch Office open in Malaysia

As a foreign company like to open a branch of the parent company to enjoy tax. Need for opening branch are as follows: –

- Board Meeting Resolution to open a branch office in overseas.

- Remittance of Ringgit 500K to 1000K along with accounts report.

- Business profile and certified copies need to submit to examine.

- Branch Office open might take 2 weeks’ time in total unless discrepancy asks for.

New company registration fee in Malaysia

| Category | Consultancy and Government Fee | Type of company |

| A | Total (package): RM 3500 (new company registration fee + professional fees in Malaysia) | For small size company, those are service or general trading company |

| B | Total (package): RM 4000 (As company registration in Malaysia for foreigner fees include government & professional) | For medium-size company: import-export company |

| C | Total (package): RM 4000 New company registration Malaysia by SSM fees + professional) | For large size company: Manufacture Company |

Registration and license fees as follow: –

| Description of services | License | Fees |

| Service cover: – Company Incorporation Service. Buy super form from SSM My DataSecretary service 1-yearAllow office address use for 1 year and bank account open service | Incorporation by SSM | 3500-4000 |

| Prepare supporting papers and apply for signboard and premise license | Signboard & Premise | 2000 |

| Prepare supporting papers and apply for export and import license | Export & Import | 3500 |

| Prepare supporting documents and apply for WRT license for non-residents | WRT | 3500 |

| Prepare supporting papers and apply for Kinder garden school license and many more | Dagang.net | Depends on steps |

| Add product and/ or brand name with company name permission | Notification | 1000 |

| Prepare supporting papers and apply for Trademark license. | Trade Mark | 2500-5000 |

Do not hesitate to Contact Us today for immediate Service. Call/Whatsapp us now.

Our guideline and fees of company registration in Malaysia for a foreigner are as follows: –

Company Act 2016, key sections are going to discuss as a need for company registration:

| Section 17 | Company Formation | (1) One or more persons are eligible to incorporate a new company. (2) The company may be as the following category— (a) a company limited by shares; (b) a company limited by guarantee that is not shared; (c) a company can be limited both by shares and guarantee, or (d) another one is an unlimited company. |

| Section 15 | Private Limited Company | (a) restricts the right to transfer its shares in case of a private limited company in Malaysia; (b) Members limitation up to fifty (50) most. (c) Public subscription is not permissible being a private limited company |

| Section 16 | Registration and incorporation | Certificate of incorporation (4) The registrar will certify with a seal that is— (a) a company limited by shares; (b) a corporation limited by guarantee that is not shared; (c) a company can incorporate as limited both by shares and guarantee; or (d) another one is an unlimited company. |

| Section 17 | Incorporation Certificate | (1) A firm cannot be an associate of a company which is its holding company will cancel. |

| Section 18 | Requirements on memorandum | (1) There will be a name of company, goal, shares, name of directors, auditor, first secretary, and others. |

| Section 14 | Return about allotments | Where a company will allot shares to the directors with the value of each share. |

| Section 124 | Qualification of director | Shares will buy by the shareholders as mentioning the number of Article of Association. Penalty: In case of failure One thousand RM penalty as Default penalty. |

| Section 143 | Annual general meeting | Each after 12 months company will hold a meeting with presence of the directors as name AGM. On condition that twenty-one months may consider in case of first AGM |

| Section 152 | Special resolutions | A meeting resolution will pass by the ¾ majority voting as name of Special resolution |

| Section 165 | Annual return submission by corporation in favor of a share money | Return should be part II English Schedule of every company. Penalty: Two thousand ringgit(Default penalty) |

| Section 217 | Application of winding up | Every company can petition by court for winding up the company |

At a glance process of Company Registration in Malaysia for a foreigner:

| Questions | Answers |

| How many shareholders are needed? | 1 (one) |

| How long take to register Sdn Bhd? | 3-4 days |

| How much paid-up capital is needed? | To register Rm1 only, to apply for an investor visa,350K for JV and 500K-1000K for foreign ownership company |

| Do I need to have an office in Malaysia? | Yes (Virtual office also allow). |

| What about authorized capital? | It is no longer now a day. |

| How much is the cost of registration as a foreign-owned company? | Ringgit 4000 in total for incorporation. |

| How many other licenses are needed to start a business? | Signboard, Premise, Export and Import, Notification, Halal, WRT, ESD. |

| Can Premier Three Consulting Firm assist to open a bank account? | Yes, we ensure the bank account in foreign banks. |

| How I will buy a shelf company? | A shelf is a ready company but business is not run yet. We provide the same if you want to buy from us. |

| Do I need nominee director in Malaysia? | Must |

| How much cost for nominee director service? | Ringgit 5000 |

| Can a foreigner register a company in Malaysia? | Yes, can. And foreigners can hold 100 percent shares of the company. |

| Can foreigner open restaurant in Malaysia? | Yes, can. A foreigner can open a restaurant in Malaysia. But WRT and Halal licenses are additionally needed. |

| How can I get a business visa in Malaysia? | Only ESD registration company can apply of Business Visa. |

| Can a foreign company open bank account in Malaysia? | Yes, can. Expert of Premier Three can assist to open a Business bank account for foreigners in Malaysia (HSBC, OCBC, Standard Chartered, UOB, RHB) |

| Is it allowed to register a company without an investor visa? | Yes. Allow. |

| Is 100 present foreign ownership allow in Malaysia? | Yes. Allow. Foreign investors can hold 100 percent ownership. |

| Does local nominee directorship need to register a new company? | No. As a guideline of FDI without local nominee director, a foreign investor can open company. |

| Which banks recommended to open a corporate account in Malaysia as a foreigner? | HSBC, UOB Bank, RHB Bank, OCBC Bank & Standard Chartered Bank |

| How can I open a bank account as a foreign shareholding company? | PREMIER THREE CONSULTING FIRM will assist you |

| How much should invest in a joint venture company? | RM 350,000 instead of RM 500,000 as recommended. |